Why Warren Buffett’s Berkshire Halved Its Apple Stake

Warren Buffett surprised the investment world by reducing Berkshire Hathaway’s position in Apple nearly by half.

Published Aug 7, 2024

Table of Contents

- Why Buffett sold Apple

- A catalyst for change?

- Apple's decline and Berkshire's strategy

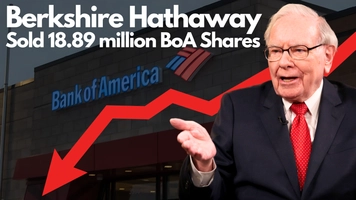

Market analysts are still gasping for breath after Warren Buffett nearly halved Berkshire Hathaway’s huge position in Apple during Q2 2024. This decision increased Berkshire’s cash position to $277 billion, which is historically high for the company.

Why Buffett sold Apple

Buffett, known for his love for Apple Inc, recently decided to reduce his holdings in the company by $3.2 billion which is nearly 50% may have been prompted by fears over the future growth of the company as well as its valuation. Since Apple’s shares have been recently on the rise in the market and touching new peaks, the sale could be attributed to the fact that it was part of Berkshire’s plan to diversify its portfolio to hedge it against fluctuations in the future. Furthermore, Buffett suggested that such sales could also resolve future tax issues.

A catalyst for change?

The departure of Berkshire’s vice chairman, Charlie Munger, towards the end of 2023 also might have played a role in this decision. Munger had a positive bias towards Apple and his nonattendance may have made Buffett question the conglomerate’s dependence on the tech company. After Munger’s death, sales of Apple’s stocks have been increasing suggesting that Munger’s optimism about Apple’s future earnings might have helped the company.

Apple's decline and Berkshire's strategy

After the announcement to sell the company, Apple’s share value fell by nearly 5%, indicating skeptical investors over Buffett’s move. Self-generated stocks such as Berkshire Hathaway and Bank of America also feel the pushback of the market. However, the company’s operating earnings increased to $11. Analysts like Jim Shanahan of Edward Jones suggest that this move could signal further reductions in Berkshire’s Apple stake.

Warren Buffett’s decision to cut Apple’s stake significantly shows the risks and possibilities in the modern economy. Whether this decision will pay off in the long run remains to be seen, but one thing is certain: Buffett’s radical decision-making remains a significant influence in the sphere of finance.

Write a comment

Comments

No Comments Yet