Warren Buffett's Berkshire Hathaway Reduces Stake in Bank of America

Berkshire Hathaway’s streak of selling Bank of America shares in its sixth consecutive trading day of reductions.

Published Jul 30, 2024

Table of Contents

- Recent Sales and Financial Impact

- Remaining Holdings and Historical Context

- Performance and Market Speculation

- Other Investment Moves

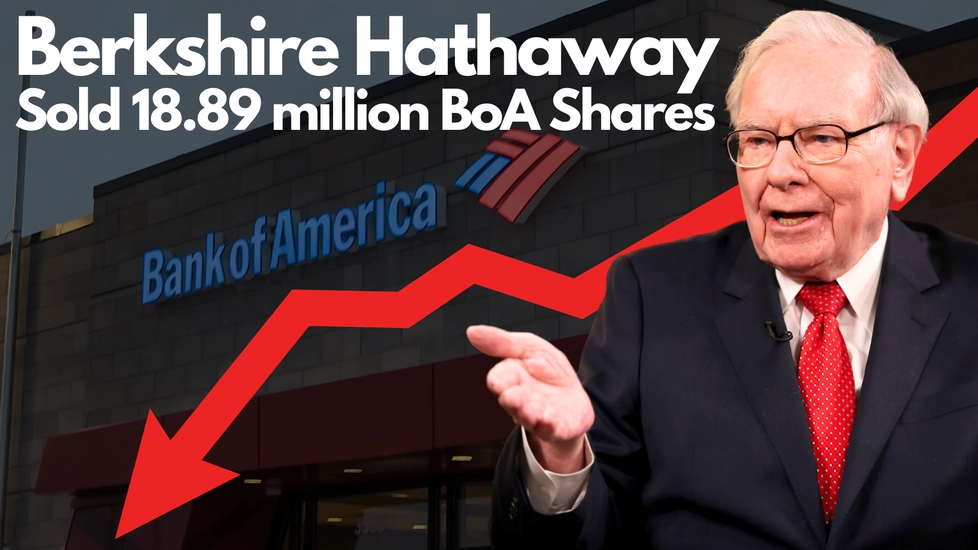

Warren Buffett's Berkshire Hathaway has continued its streak of selling Bank of America shares, marking the sixth consecutive trading day of reductions. This move marks a significant change in their investment strategy, given Buffett's previously stated confidence in the bank.

Recent Sales and Financial Impact

The latest Form 4 filings reveal that between July 22 and July 24, Berkshire sold 18.89 million shares at average prices between $42.38 and $42.56, amounting to a total of $802.5 million. The conglomerate has sold 52.8 million shares, valued at over $2.3 billion, over the last six trading days. Despite these sales, Berkshire still holds a significant stake in Bank of America, with 980.06 million shares, representing a 12.5% ownership.

Remaining Holdings and Historical Context

Buffett's relationship with Bank of America began in 2011 when he invested $5 billion in preferred stock and warrants during a period of declining confidence in the bank. This investment was seen as a strong vote of confidence. As recently as last year, this American investor expressed his admiration for CEO Brian Moynihan and the bank's management team.

Performance and Market Speculation

Some might speculate that the sales are due to Bank of America's performance, but the bank's shares have risen by 24% this year, surpassing the S&P 500's year-to-date return of 16%. Buffett, widely known as the Oracle of Omaha, is under no need to reveal the motives behind his sales, which may have more to do with diversification than a decline in confidence in the bank. Furthermore, the decision may be influenced by the banking sector's reliance on federal interest rates, given the expectation of a decrease in rates in September. However, only Buffett and Berkshire know the true reasons.

Other Investment Moves

Berkshire Hathaway has been active in other sectors, acquiring shares in Occidental Petroleum, Liberty Media Corp. Series A, and Liberty Media Corp. Series C while lowering its holding in Bank of America. These moves suggest a broader strategy of adjusting the investment portfolio to better align with market conditions and opportunities.

Overall, the recent sales of Bank of America shares by the CEO of Berkshire Hathaway signify a notable shift in their investment approach. While the exact reasons remain undisclosed, the sales are a reminder of the dynamic nature of investment strategies, even for long-term investors like Warren Buffett. The market will be cautious about any new developments and possible clues on Berkshire's evolving investment philosophy.

Write a comment

Comments

No Comments Yet